Repo Business Ireland : 5 Steps to Success

Welcome to an exploration of the Repo Business Ireland landscape in Ireland. Repo, short for repurchase agreement, plays a significant role in the financial markets, facilitating short-term borrowing and lending transactions. In this article, we will delve into the fundamentals of repo transactions, the regulatory environment in Ireland, key market players, operational aspects, risks, opportunities, and recent trends shaping the repo business in the country. Whether you’re a financial professional, investor, or simply curious about the intricacies of Ireland’s financial markets, this article aims to provide valuable insights into the repo business domain. Let’s dive in.

Understanding the Repo Business Ireland

The repo market, also known as the repurchase agreement market, is a crucial component of the global financial system, including Ireland’s financial landscape. In a repo transaction, one party sells securities to another party with an agreement to repurchase them at a later date, typically at a higher price. Here are some key aspects to understand about the repo market:

1.1 Purpose and Function Repo transactions serve as a means for short-term borrowing and lending, providing liquidity to financial institutions and enabling them to manage their short-term funding needs. They allow market participants to obtain cash by temporarily selling securities while agreeing to buy them back later, often within a few days or weeks.

1.2 Participants The participants in the repo market include banks, investment funds, government entities, central banks, and other financial institutions. These entities engage in repo transactions either as borrowers seeking short-term funding or as lenders looking to deploy excess cash.

1.3 Types of Repos There are various types of repo transactions, including bilateral repos, tri-party repos, and cleared repo transactions. Bilateral repos involve direct agreements between two parties, while tri-party repos involve a third-party intermediary facilitating the transaction and providing collateral management services. Cleared repo transactions are settled through central clearinghouses, reducing counterparty risk.

1.4 Collateral Collateral plays a crucial role in repo transactions, providing security to the lender in case of default by the borrower. The collateral typically consists of high-quality securities, such as government bonds, agency securities, or highly-rated corporate bonds. The value of the collateral often exceeds the cash borrowed in the repo transaction, providing a buffer against market fluctuations.

1.5 Pricing and Terms Repo transactions are priced based on the interest rate differential between the cash borrowed and the securities pledged as collateral. The interest rate, known as the repo rate, is determined by market conditions, creditworthiness of the parties involved, and the quality of the collateral. Repo transactions can be conducted overnight, termed as overnight repos, or for longer durations, known as term repos.

1.6 Role in Financial Markets The repo market serves as a critical source of funding and liquidity for financial institutions, allowing them to meet regulatory requirements, manage their balance sheets efficiently, and support their trading and investment activities. It also provides valuable insights into market conditions, interest rate expectations, and investor sentiment.

Legal and Regulatory Framework for Repos in Ireland

The repo market in Ireland operates within a comprehensive legal and regulatory framework aimed at ensuring transparency, stability, and investor protection. Understanding the regulatory landscape is crucial for market participants to comply with applicable laws and regulations. Here’s an overview of the legal and regulatory framework governing repos in Ireland:

2.1 Central Bank of Ireland (CBI) The Central Bank of Ireland (CBI) plays a central role in regulating the financial markets, including the repo market. The CBI sets and enforces regulations related to financial stability, market conduct, and prudential supervision to safeguard the integrity of the financial system.

2.2 European Securities and Markets Authority (ESMA) As a member of the European Union (EU), Ireland is subject to regulations issued by the European Securities and Markets Authority (ESMA). ESMA establishes harmonized rules and standards for financial markets across the EU, including regulations relevant to repos, such as the Markets in Financial Instruments Directive (MiFID) and the European Market Infrastructure Regulation (EMIR).

2.3 Irish Financial Services Regulatory Authority (IFSRA) The Irish Financial Services Regulatory Authority (IFSRA) oversees the conduct of financial institutions operating in Ireland. It ensures compliance with regulatory requirements, conducts inspections and investigations, and imposes penalties for regulatory breaches.

2.4 Financial Services Regulatory Framework Ireland’s financial services regulatory framework encompasses laws, directives, and regulations governing financial activities, including repos. These regulations cover areas such as capital adequacy, risk management, disclosure requirements, and investor protection.

2.5 Securities Regulation Repo transactions involve the transfer of securities as collateral, making securities regulation an integral part of the regulatory framework. Regulations governing securities issuance, trading, custody, and settlement ensure the integrity and efficiency of securities markets in Ireland.

2.6 Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) AML and CTF regulations aim to prevent financial crime by requiring financial institutions to implement robust due diligence measures, customer identification procedures, and transaction monitoring systems. Compliance with AML and CTF regulations is essential for participants in the repo market to mitigate the risk of illicit activities.

2.7 Market Infrastructure Regulation Market infrastructure regulation governs the operation of financial market infrastructures, such as central counterparties (CCPs) and central securities depositories (CSDs), which play a crucial role in repo transactions. Regulations ensure the safety, efficiency, and resilience of market infrastructure providers, reducing systemic risk.

2.8 Regulatory Reporting and Transparency Regulatory reporting requirements mandate market participants to report repo transactions to regulatory authorities, providing transparency and oversight of market activities. Reporting obligations help regulators monitor market dynamics, assess systemic risks, and detect potential misconduct.

2.9 Compliance and Enforcement Compliance with regulatory requirements is essential for all market participants involved in repo transactions. Regulatory authorities conduct inspections, audits, and investigations to enforce compliance with applicable laws and regulations. Non-compliance can result in regulatory sanctions, fines, or legal consequences.

Market Dynamics and Participants in the Repo Business Ireland

Understanding the dynamics and key participants in the repo market is essential for stakeholders to navigate the complexities of repo transactions effectively. Here’s an overview of the market dynamics and key participants in the Irish repo business:

3.1 Market Dynamics The repo market in Ireland is dynamic, with transactions driven by various factors such as liquidity needs, funding costs, regulatory requirements, and market sentiment. Market dynamics can influence the volume, pricing, and tenor of repo transactions, impacting market participants’ strategies and decision-making.

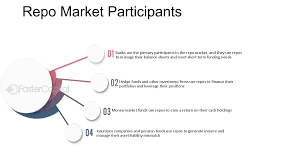

3.2 Key Participants The repo market in Ireland comprises diverse participants, each playing a specific role in facilitating repo transactions. Key participants include:

- Banks and Financial Institutions: Banks and financial institutions are active participants in the repo market, engaging in repo transactions to manage liquidity, fund operations, and optimize their balance sheets.

- Asset Managers and Investment Funds: Asset managers and investment funds participate in repos to deploy excess cash, enhance portfolio returns, and obtain securities for short-term investment or hedging purposes.

- Central Bank: The Central Bank of Ireland (CBI) acts as a key participant in the repo market, conducting repo operations as part of monetary policy implementation, providing liquidity to financial institutions, and influencing short-term interest rates.

- Broker-Dealers and Intermediaries: Broker-dealers and intermediaries facilitate repo transactions by matching buyers and sellers, providing trading platforms, and offering execution services to market participants.

- Corporate Treasuries: Corporate treasuries utilize repo transactions to optimize cash management, finance working capital needs, and invest excess cash in short-term, secured instruments.

- Central Counterparties (CCPs): CCPs play a crucial role in mitigating counterparty risk in repo transactions by acting as a central counterparty, guaranteeing settlement, and providing novation services to parties involved in repo transactions.

- Government Securities Issuers: Issuers of government securities, such as sovereign bonds and treasury bills, participate in the repo market to finance government debt, manage cash balances, and ensure the efficient functioning of the government securities market.

- Regulators and Supervisory Authorities: Regulatory and supervisory authorities oversee the repo market, setting rules and regulations, monitoring market activities, and ensuring compliance with legal and regulatory requirements to maintain market integrity and stability.

3.3 Market Infrastructure Market infrastructure providers, including central securities depositories (CSDs), central counterparties (CCPs), trading platforms, and clearinghouses, play a critical role in facilitating repo transactions. These infrastructure entities ensure efficient settlement, risk management, and transparency in repo markets, enhancing market liquidity and reducing counterparty risk.

3.4 Trading Practices and Strategies Market participants in the Irish repo business employ various trading practices and strategies to optimize their positions, manage risk, and achieve their financial objectives. Common trading practices include bilateral and tri-party repo arrangements, term and open-market repos, matched-maturity repo transactions, and collateral transformation strategies.

3.5 Risk Management Effective risk management is essential for participants in the repo market to mitigate counterparty, credit, liquidity, and operational risks. Market participants employ risk management practices such as collateral valuation, margining, stress testing, and counterparty credit analysis to safeguard their interests and ensure the stability of the repo market.

3.6 Market Liquidity and Pricing Market liquidity and pricing dynamics influence repo transactions, with liquidity conditions and market demand impacting repo rates, haircuts, and collateral eligibility criteria. Participants monitor market liquidity indicators, yield curves, and market benchmarks to assess pricing levels and execute repo transactions at favorable terms.